By: Bing Ledesma – De Los Reyes

Everyone wants quality life but what does that mean?

How do you define quality life? What is quality life for one may not necessarily be quality life for another as it is really relative. A common definition though is this – when we are able to do what we want to do for ourselves and for others…that is quality life.

Being able to do what we want to do for ourselves and for others…that is quality life.

For ourselves: being able to eat whatever and wherever we want; buy not only what we need but also what we want; travel wherever and whenever and do our hobbies and passions so we continue to be productive and feel good about it.

For others: when family members need help, we can always help; when family members and friends have special occasions, we can be there to celebrate with them; we’re able to help the community and be involved in church and social causes we believe in.

That’s how I define quality life and it does not happen like magic. You’ve got to work for it. Of course there are those who were born into affluence which makes the process easier but for most, it needs to be planned and worked out.

Mine is such. Born to a poor family, my parents had to work very hard to make both ends meet. I’m grateful for having parents who believe that being born poor is not our fault but to die poor, we only have ourselves to blame. We can work ourselves out of poverty.

Putting value in education is my parents’ way of giving us, their children, a chance to live a better life. Being diligent as a student was my way of honoring them; ensuring I utilize my capabilities at work is my way of glorifying God who made it all happen and incalculating good values in my family is my way of paying it forward.

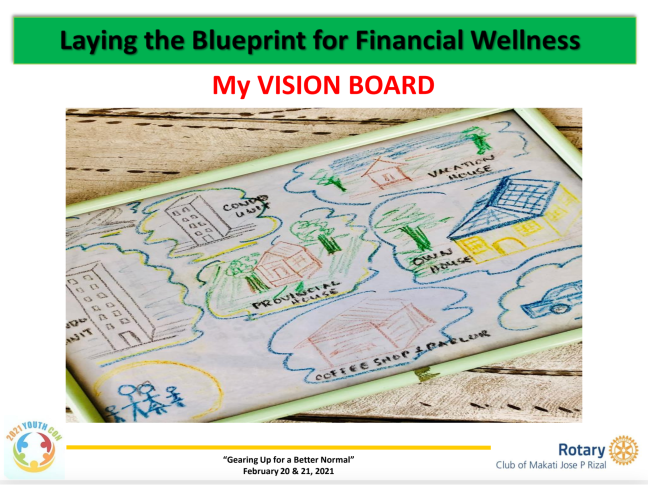

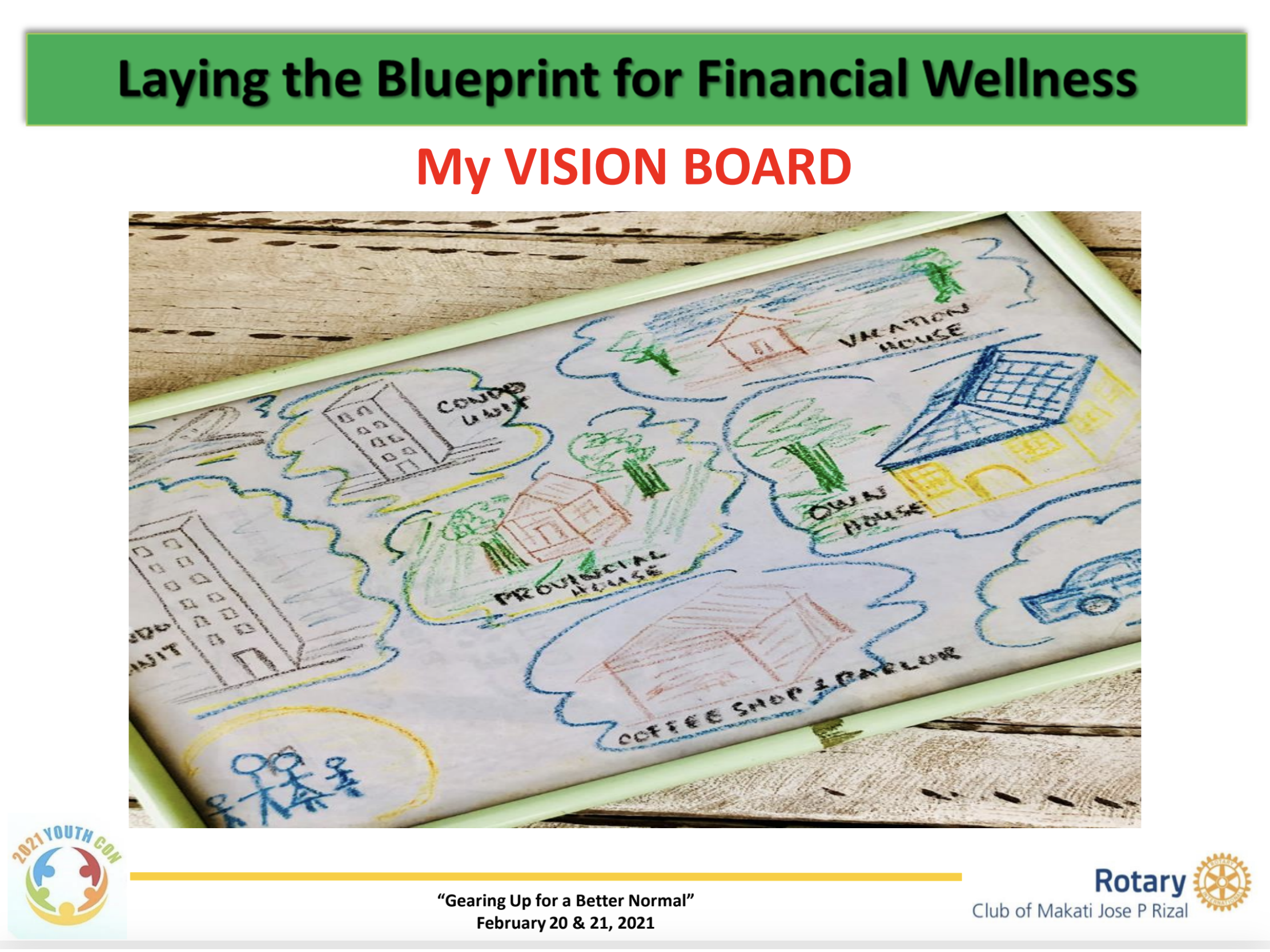

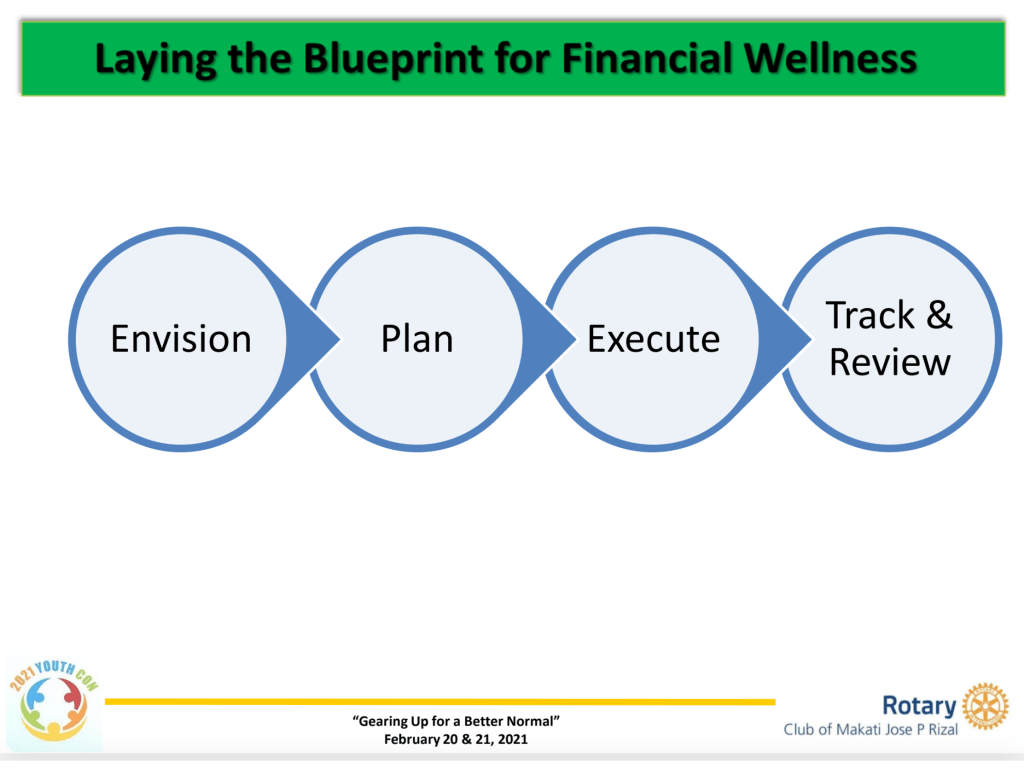

So how do we ensure that we live our kind of quality life? That is where financial planning comes in. I firmly believe that no one can live a comfortable life at every stage without planning for it and if you start early, there is so much you can do. If you do it right, you increase your chances of having your kind of quality life.

So start planning and start early.